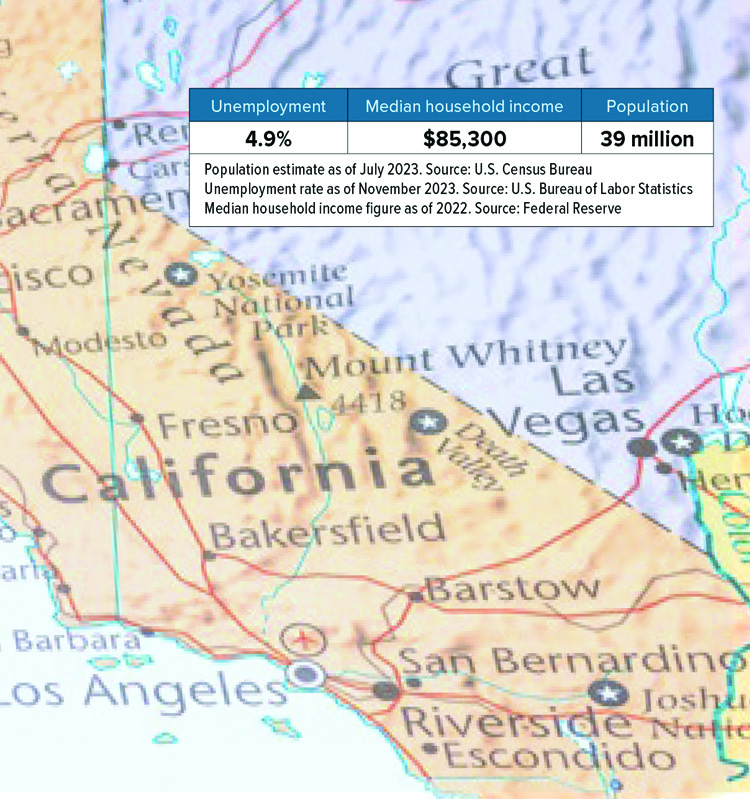

It’s common knowledge that California has an affordability problem. It’s the most expensive state in the nation to buy a house, with the median sales price now outpacing even Hawaii. As the most populous state in the country, California also has the most powerful economy of any state.

Its beauty encompasses ski-ready slopes, alpine lakes, sandy beaches and glittering skyscrapers. And it’s a cultural center, where stars are born and trends are set. But for the average Californian, the cost of living is too high. Only 15% of households could afford a median-priced home as of third-quarter 2023, according to the California Association of Realtors. Consequently, California has the second-lowest homeownership rate among all states, trailing only New York.

More construction is desperately needed, but zoning issues, expensive fees, high material costs and scarce land make it difficult for developers. New zoning rules and approval processes have been implemented since Gov. Gavin Newsom took office in 2019, but most changes focus on multifamily buildings in an attempt to ease the state’s rental affordability crisis.

The number of new homes built reached a 15-year high point in 2022, but demand still isn’t being met. State officials say 180,000 new units per year are needed, with about 123,000 built in 2022. About half of those were single-family homes. The state wasn’t on track to meet that number in 2023. From January through November, 53,000 permits were authorized for new single-family homes.

Californians are getting creative to achieve homeownership, despite the challenges and a more expensive mortgage market. Many buyers are choosing to put down more money, with help from family or local downpayment assistance programs. Those who can are paying in cash or buying down interest rates. And many are choosing to “house hack.”

House hacking came to prominence several years ago, and renting out extra bedrooms to help pay the mortgage has become a relatively common practice. But Californians are leading the charge on a different kind of house hacking: the construction of accessory dwelling units, or ADUs.

Zoning changes in 2017 made it much easier to add ADUs to single-family lots in California, and construction of these units grew from 1,100 in 2016 to 20,600 in 2022 — or nearly 17% of all units built that year. ADUs are faster and less expensive to build than traditional homes.

These units can be financed with home equity loans and cash-out refinances. In October 2023, the Federal Housing Administration (FHA) property rehab financing program was updated to allow more ADUs to qualify. Additionally, FHA underwriting will now recognize both existing and anticipated rental income from ADUs to qualify borrowers. California even has a grant program to help lower-income homeowners build ADUs.

This trend may not solve the housing crisis in California, but ADUs can help homeowners afford their mortgage while raising their property value. Even if they’re not being rented, ADUs are a good option for homeowners looking to create multigenerational housing for family members without sacrificing privacy or space in their home. ●

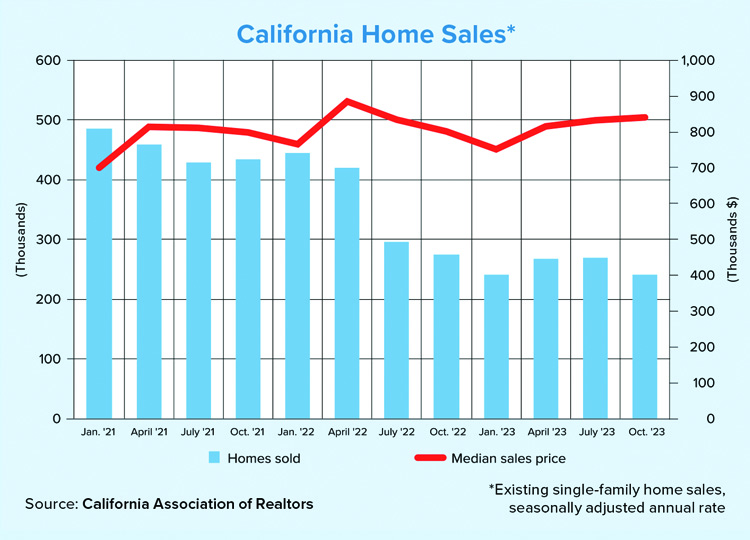

Home sales in California, which slowed significantly in the second half of 2022, rebounded slightly in the second and third quarters of 2023 before falling again. According to the California Association of Realtors (CAR), the seasonally adjusted annual rate of existing single-family home sales in the state totaled 223,940 in November. This was the lowest rate recorded since the Great Recession and represented a 5.8% year-over-year decrease.

Bolstered by a lack of supply, median home prices rose last year. In January 2023, the median price was $751,330, the lowest since first-quarter 2021, according to CAR data. Prices wobbled but rose throughout the year to reach $822,200 in November.

Despite overall growth in home prices, California’s most expensive markets saw the most dramatic declines in the nation, according to a SmartAsset analysis of Zillow data. The Bay Area cities of Dublin, San Francisco, Palo Alto and Fremont were the four cities most impacted, with home values dropping by an estimated 13% to 15% during the year ending in May 2023.

What the Locals Say

The Greater Sacramento market has definitely slowed down in the past year, but it’s still a healthy market, in my opinion. We have a lack of resale homes on the market, but there’s a lot of new home construction in the area. Unlike the Bay Area, we have more land availability, so we have more developers who are taking some of the agricultural lands and expanding out. Our boundaries are pushing out, and we’ve got a lot of opportunity and a lot of growth.

Right now, I would say the majority of homes being purchased are new construction. They have more inventory and there’s more building going on. On the resale side, I would say it’s slowed down, but it’s still a very hot market. If homes are priced right, they’re selling in 10 to 15 days. The market is still strong, but new home construction is stronger than resale.

I’m seeing people from the Bay Area and other states that are wanting to move out of those locations. They want larger homes, larger yards, more community. We have that affordability compared to a lot of major cities in the United States. We have the ability to be outdoors all year round, with accessibility to Lake Tahoe, the Bay Area, San Francisco and Southern California. It’s a lot safer than a lot of other cities, and you have community support and that small-town feel.

Senior mortgage officer

Safe Credit Union

3 Cities to Watch

ANAHEIM

Due to its status as an entertainment destination, Anaheim has an economy that differs from many of its Southern California neighbors. Disneyland generates billions of dollars each year for the regional economy. This once-affordable Orange County market saw a 14.2% increase in median home sales prices during the year ending in September 2023, the biggest uptick in the nation. The metro area’s median price is now $1.1 million, while the median price in the city is $875,000.

CHULA VISTA

The San Diego metro area is pricey, with households in nearly every city and suburb paying more than half of their income on major homeownership expenses. The exception is Chula Vista, the bayside city that’s south of San Diego and just north of the Mexican border. On average, homeowners here allocate 48% of their income to mortgage and real estate tax payments, with a median asking price of $725,000 and a median household income of $96,200.

BERKELEY

The Bay Area has seen home values tumble in the past year after prices shot up 36% from 2020 to 2022. Berkeley is no stranger to this phenomenon as the city’s estimated average home value fell by more than 11%, or $183,000, during the year ending in May 2023. But the highly desirable suburb, home to the University of California at Berkeley, was slightly more insulated than some of its more expensive neighbors, which saw prices plummet by as much as 15%.

Sources: Bankrate, California Association of Realtors, California Department of Finance, CalMatters, Forbes, John Burns Research and Consulting, KSWB-TV, Los Angeles Times, Office of Gov. Gavin Newsom, Orange County Register, San Francisco Chronicle, SmartAsset, The Real Deal, The Sacramento Bee